Let's Work Together to Help Protect Your Money

We are seeing a significant increase in fraud and scams and want to be sure your accounts and identity are safe. Please be aware of these common fraud attempts and take steps to help keep your money and your account safe.

New Scam Alert: Email Spoofing

Email spoofing is a technique used by malicious actors to send emails with a forged sender address. In other words, the sender's address is manipulated to appear as if it's coming from a trusted source when it's actually from an attacker. This can be done by altering the "From" field in the email header to mimic a legitimate email address or domain.

Spoofed emails are often used in phishing attacks, where the sender tries to trick recipients into providing sensitive information such as login credentials, financial data, or personal information. These emails may appear to be from a bank, a trusted company, or even someone the recipient knows.

How to Avoid Being Spoofed

Be cautious when receiving unsolicited emails, especially if they contain requests for sensitive information or seem suspicious in any way.

If you suspect that you've received a spoofed email from your bank, it's important to take action to protect yourself and your financial information. Here are some steps you can take:

- Do not click on any links or download any attachments: Spoofed emails often contain malicious links or attachments that can compromise your computer's security or lead you to phishing websites. Avoid interacting with any content within the email until you've verified its authenticity.

- Verify the email sender: Check the sender's email address carefully. Spoofed emails may have slight variations in the sender's address or domain name that can be easy to overlook. Look for any signs of inconsistency or unusual behavior.

- Contact us directly: Use a trusted method to reach out to your bank, such as calling the customer service number listed on their official website or visiting a branch in person. Inform them about the suspicious email you received and ask if it's legitimate. Banks typically have dedicated departments to handle security concerns like this.

- Forward the email to our team: If you suspect an email may be spoofed, please forward it to service@OneDetroitCU.org. This can help our security team investigate the issue and take appropriate action.

- Delete the email: Once you've reported the suspicious email to your bank and taken any necessary precautions, delete the email from your inbox and trash folder to prevent any accidental interactions with its contents.

- Monitor your accounts: Keep an eye on your 1DCU accounts for any unauthorized or suspicious activity. If you notice anything unusual, report it immediately.

- Educate yourself and others: Learn more about how to spot phishing emails and educate your friends, family, and colleagues about the dangers of email spoofing. Awareness is key to preventing these types of attacks.

By taking these steps, you can help protect yourself and others from falling victim to email spoofing scams.

Fraud Prevention Tips

One Detroit Credit Union employees or card security services will never ask you to verify personal information, including:

- Your member number, date of birth, and social security number

- Full debit or credit card numbers or PIN

- Online/Mobile banking login

Scammers pretend to be from One Detroit Credit Union. Even if your caller ID, text or email says One Detroit Credit Union be cautious. If you're not 100% sure it's really 1DCU, end the conversation and call the number on your account statement.

If you feel you've been compromised, change passwords for online/mobile banking and call us immediately.

We're Here for You: Reporting Fraud and Other Security Issues

Unauthorized Transactions

If an unauthorized transaction was posted to your account, you can dispute the charge and report fraud online.

Inaccurate Transactions

If you deliberately made a transaction that doesn’t appear correct on your debit or credit card accounts, you should dispute it.

Lost/Stolen Cards

If your card is lost or stolen, there are steps you can take to protect your account from the risk of having fraudulent transactions.

For lost or stolen debit/ATM cards, please call (313) 965-8640 and follow the prompts on our automated voice system.

For lost or stolen VISA cards, please call (800) 325-3678.

How to Block Your Card Using the 1DCU Mobile App

- Login to online banking or the 1DCU mobile app.

- Click on "cards" on the main menu.

- Select "block the card" on the card you wish to block.

- A pad lock icon will display, showing that the card has been blocked.

- You may choose to keep a card blocked when not in use to help deter online fraud.

Account Alerts

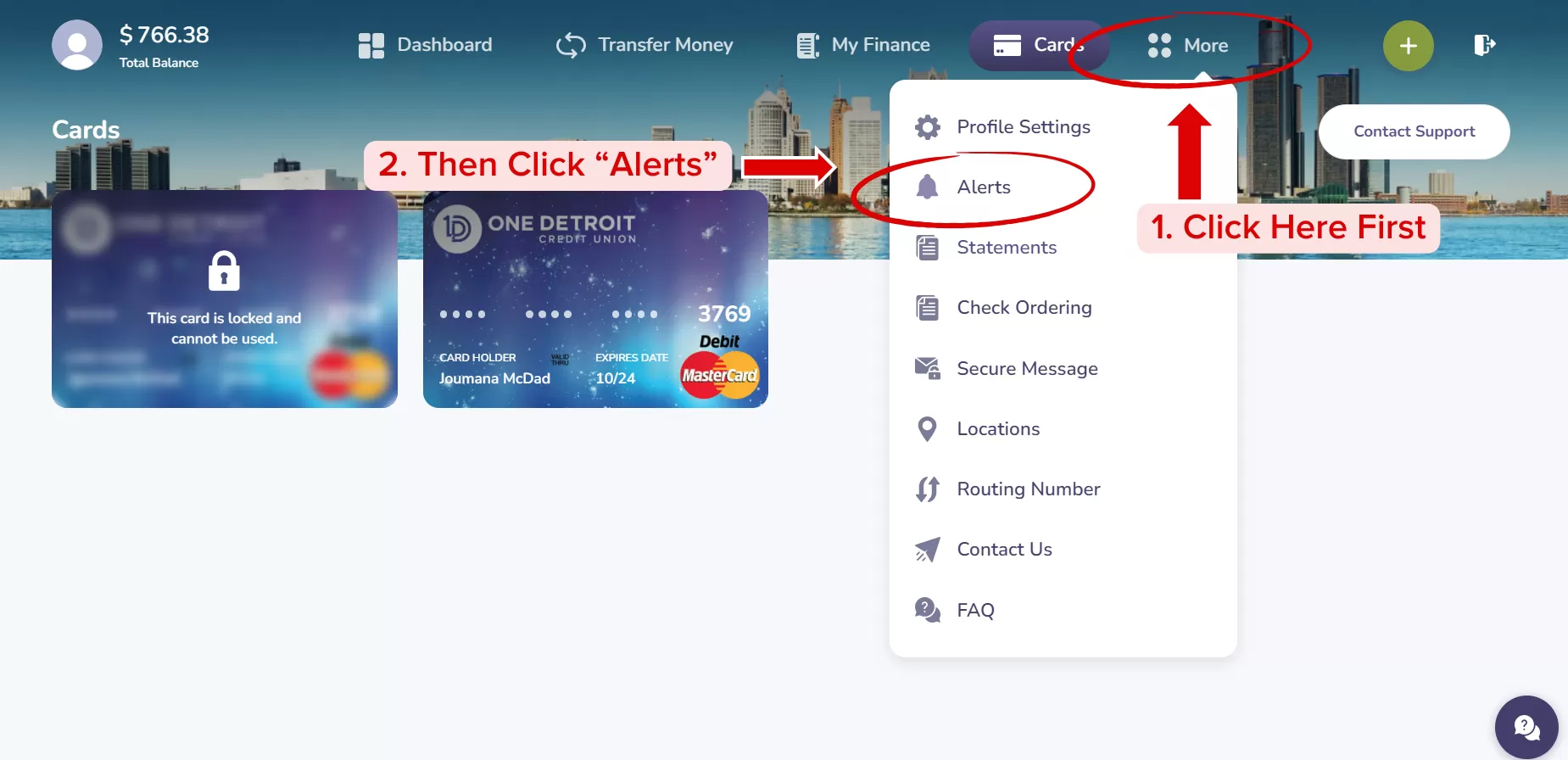

Alerts need to be set up on a desktop or laptop computer.

- Login to your account.

- Click "more" on the main menu then select "alerts".

- Select which account(s) you want to add an alert to.

- Choose whether you want to set an alert for withdrawals, deposits, balance limits or something else.

- Enter the amount or limit that you want to be notified.

- Choose whether you want to be notified by text, email or both.